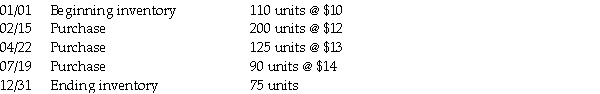

The following data was obtained from the records of Bitter Inc., for the current year:

Additional information: Sales are $25,000; operating expenses are $14,500; the tax rate is 40%.

Additional information: Sales are $25,000; operating expenses are $14,500; the tax rate is 40%.

REQUIRED: Prepare the income statement using:

• FIFO.

• LIFO.

• Average cost.

Definitions:

Universal Proposition

A statement or proposition that asserts something of all members of a specific class or category.

Referents

Objects or events in the world that words or phrases refer to or denote.

Complement

A term designating the class of all things excluded by another term.

Nonbowlers

Individuals who do not participate in the sport or activity of bowling.

Q5: Uncollectible-account expense is an operating expense on

Q11: WorldCom committed financial statement fraud by:<br>A) expensing

Q43: Under the equity method, if the Investment

Q108: A budget is a financial plan that

Q118: Bigg and Talle Corporation uses the percent-of-sales

Q118: The carrying amount of bonds at maturity

Q133: When a note matures, _ on the

Q155: For each of the following situations, indicate

Q157: Managers control cash receipts and disbursements, as

Q160: Accrual accounting records the impact of both