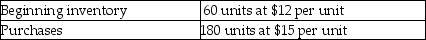

The following data was collected from the accounting records of Ambrose, Inc., for the month of June. 200 units were sold during the month. Ambrose currently uses the FIFO method of valuing inventory.  What would have been the difference in Ambrose's ending inventory under the LIFO costing method?

What would have been the difference in Ambrose's ending inventory under the LIFO costing method?

Definitions:

Aggressive Optimism

A mindset or investment strategy characterized by a high expectation for positive outcomes, often leading to higher risk-taking.

Conservatism

In accounting, it is a principle that requires potential expenses and liabilities to be recognized immediately, but revenues only when they are ensured.

Indirect Planning Assumptions

Presumptions made about external factors that could influence an organization's planning, without direct control over them.

Direct Planning Assumptions

Fundamental assumptions that are explicitly stated and used as a base in the strategic planning and forecasting processes.

Q5: The year-end concept requires a company to

Q17: Smart hiring practices and separation of duties

Q24: Consolidated financial statements are prepared when a

Q53: An example of an intangible asset is:<br>A)

Q60: Credit Company had the following inventory data

Q78: To determine cost of goods sold under

Q100: Under the periodic inventory system:<br>A) the inventory

Q119: Equity is increased when company makes a

Q133: When determining what duties need to be

Q168: A ledger that contains a separate account