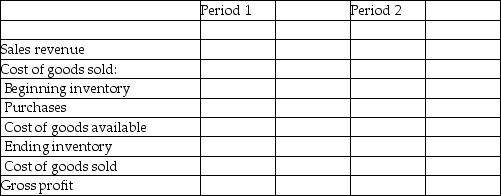

Football, Inc.'s clerk made a mistake while preparing the financial statements. The ending inventory for Year 1 should have been $20,000, but the clerk recorded it as $23,000 on the income statement. Assume that sales for Years 1 and 2 are $90,000 per year and purchases are $20,000 per year. Beginning inventory for Year 1 of $12,000 and ending inventory for Year 2 of $21,000 were correctly recorded. Complete the following income statement for Year 1 and 2.

Definitions:

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to individual units of production.

Job Order Production

A production process in which products are manufactured or services are provided based on specific customer orders, allowing for customization.

Cost Accounting System

A method of accounting that captures all costs associated with the production of goods or services to evaluate performance and make decisions.

Monitoring

Monitoring refers to the systematic process of observing, checking, and recording activities or data for a specific purpose, often to detect changes over time.

Q2: In order to effectively evaluate the days'

Q25: The weighted-average cost per unit is calculated

Q29: The type of fraud committed by company

Q47: The direct write-off method records uncollectible-account expense:<br>A)

Q72: Which of the following is a true

Q73: Given the following data, what would the

Q85: All employees should have a background check

Q86: A company uses LIFO in one year,

Q107: Goodwill:<br>A) that is created internally is recorded

Q152: Costs that extend an asset's useful life