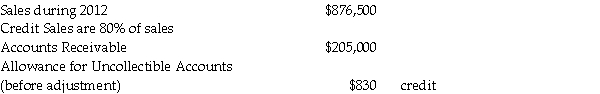

The Cat Company obtained the following information from its accounting records for the year ended December 31, 2012:

Cat Company uses the percent-of-sales method, at 2.0% of credit sales, to estimate uncollectible accounts for 2012.

Cat Company uses the percent-of-sales method, at 2.0% of credit sales, to estimate uncollectible accounts for 2012.

The president of the company wants to change to the aging-of-receivables method and estimates $12,450 as the uncollectible amount for 2012.

Prepare a schedule for the president showing the amount of the adjusting entry, ending balance in the allowance account, and the net realizable value of accounts receivable under each method.

Definitions:

Composition

The way in which something is made up, arranged, or put together, often referring to writing, music, or the arrangement of visual elements in art.

Nonverbal Communication

The process of conveying a message without the use of words, through gestures, facial expressions, and body language.

Rule-bound

Describes situations, systems, or behaviors that are strictly governed by formal rules and regulations.

Nonverbal Cues

Forms of communication that do not involve words, such as gestures, body language, facial expressions, and eye contact.

Q18: By selling on credit, companies run the

Q33: Buggy Company purchased equipment on June 3,

Q40: When computing depreciation for a plant asset,

Q48: It takes good judgment, which includes ethics,

Q96: On December 15, 2012, a company receives

Q106: A purchase order:<br>A) identifies the need for

Q111: To account for the disposal of a

Q121: A company reports accounts receivable on the

Q127: On July 25, Hockey Company's accountant prepared

Q191: The revenue principle states that revenue should