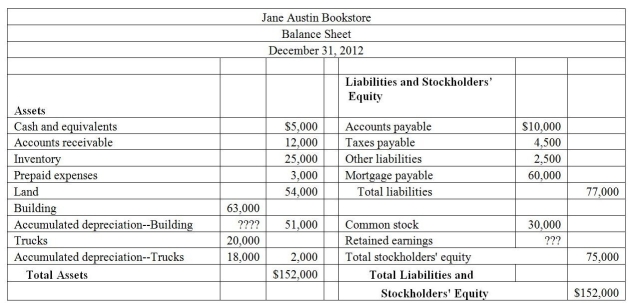

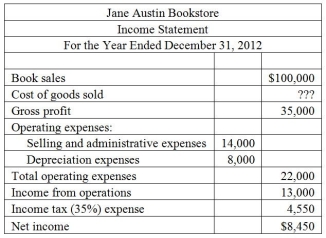

Exhibit 1.5.1 The following financial statements are to be used to answer the following questions:

-Refer to Exhibit 1.5-1. If Jane Austin Bookstore sold 10,000 books during 2012, what is the average selling price per book?

Definitions:

Deficit Reduction Legislation

Laws enacted to reduce the size of the budget deficit by increasing revenue or decreasing government spending.

Excise Tax

A tax levied on certain goods, services, or transactions, often with the aim of reducing consumption of the taxed items.

Personal Income Tax

A tax levied on individuals or households based on their total earnings from various sources, subject to exemptions, deductions, and tax rates.

Tax Reform Act

Legislation enacted to amend the tax code, often aimed at simplifying the taxation process, adjusting rates, or eliminating tax loopholes.

Q17: During the month of February, B &

Q26: When a company discontinues a segment of

Q47: A normative economic statement:<br>A)is a hypothesis used

Q64: Economists generally assume that:<br>A)firms act to maximize

Q73: The foreign-currency transaction gain account holds gains

Q87: Plymouth Corporation reported an increase in inventory

Q105: Preferred stock that requires the company to

Q128: Cost is a verifiable measure that is

Q131: Economics is as much an art as

Q147: The law of increasing opportunity cost reflects