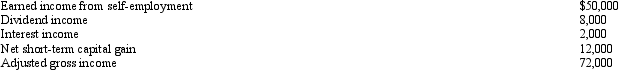

Susan is a self-employed accountant with a qualified defined contribution plan (a Keogh plan) .She has the following income items for the year:  What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2011,assuming the self-employment tax rate is 15.3%?

What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2011,assuming the self-employment tax rate is 15.3%?

Definitions:

Cognitive Mechanisms

Mental processes involved in gaining knowledge and comprehension, including thinking, knowing, remembering, judging, and problem-solving.

Physically Attractive

A characteristic of an individual that is found to be visually appealing to others, often influenced by cultural standards and biological instincts.

Conservative Attire

Clothing that is modest, traditional, and conforms to professional and formal standards, often worn in corporate or formal settings.

Sociable

Having a predisposition to engage in social interactions, often characterized by a willingness to connect and communicate with others.

Q6: If a taxpayer cannot satisfy the three-out-of-five

Q7: The Framework definition of revenue (income)differs in

Q7: The role of the Australian Securities and

Q27: SAC1 defines an entity which has users

Q31: What caused the IASB to increase the

Q47: Red Company is a proprietorship owned by

Q61: Kristen's employer owns its building and provides

Q76: Ethan,a bachelor with no immediate family,uses the

Q99: Which of the following is deductible as

Q105: Goodwill associated with the acquisition of a