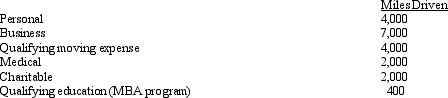

Clint uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2011,his mileage was as follows:

How much can Clint claim for mileage?

How much can Clint claim for mileage?

Definitions:

Small Hand Tools

Manual devices intended for performing specific tasks, which can be held and operated effectively with one hand.

Industrial Revolution

A period of major industrialization from the late 18th century to the early 19th century that transformed economies, work practices, and societies in many countries.

Guilds

Associations of artisans or merchants who control the practice of their craft in a particular town, historically significant for setting standards and protecting members' interests.

Unions

Organizations of workers that seek to defend and promote their members’ interests.

Q4: Why was the domestic production activities deduction

Q6: Under the actual expense method,which,if any,of the

Q14: Tonya had the following items for last

Q15: Which of the following is NOT an

Q28: Which of these is the strongest argument

Q35: Mel was the beneficiary of a $45,000

Q51: Martha participated in a qualified tuition program

Q56: The cost of legal advice associated with

Q70: Briefly explain the provisions regarding the deductibility

Q77: The amortization period in 2011 for $4,000