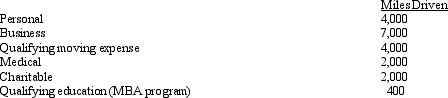

Clint uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2011,his mileage was as follows:

How much can Clint claim for mileage?

How much can Clint claim for mileage?

Definitions:

Corporation

A legal entity owned by shareholders, recognized as a separate entity from its owners, with rights and liabilities distinct from those of its members.

Transferable Shares

Shares that can be transferred from one party to another, typically without restriction.

Corporation

A legal entity recognized by law as separate from its owners, capable of conducting business, entering into contracts, and owning assets, with shareholders who invest money for the potential of profitability.

Large Companies

Businesses or organizations that operate on a large scale, often having extensive operations, personnel, and financial turnover.

Q2: Self-protective emotions are associated with:<br>A) The right

Q4: Summarize the guidelines put forth in the

Q6: A potential "benefit" to addressing conflict is

Q9: Hocker and Wilmot summarize several advantages of

Q12: According to the text,some "power moves" are

Q43: Generally,a U.S.citizen is not required to include

Q60: If a scholarship does not satisfy the

Q84: On April 15,2011,Sam placed in service a

Q105: A political contribution to the Democratic Party

Q121: After the automatic mileage rate has been