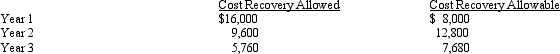

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are as follows:  If Tara sells the machine after three years for $15,000,how much gain should she recognize?

If Tara sells the machine after three years for $15,000,how much gain should she recognize?

Definitions:

Depreciation Expense

The allocated portion of the cost of a fixed asset, written off each year over the asset's useful life for accounting and tax purposes.

Scarcity

Occurs when the amount people desire exceeds the amount available at a zero price.

Choice

The act of selecting between two or more possibilities, often present in decision-making processes.

Economics

The study of how people use their scarce resources to satisfy their unlimited wants

Q10: Which of the following statements BEST describe

Q14: Sammie pays his son's real estate taxes.Sammie

Q16: Henry entertains several of his key clients

Q18: In terms of gender,"both/and" power is often

Q21: A common misconception about forgiveness is that

Q26: Select one of the five conflict styles

Q26: The key date for calculating cost recovery

Q36: Are all personal expenses disallowed as deductions?

Q43: Generally,a U.S.citizen is not required to include

Q131: In the current year,Bo accepted employment with