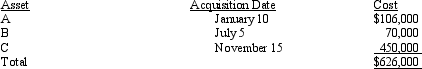

Audra acquires the following new five-year class property in 2011:

Audra elects § 179 for Asset B and Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra elects not to take additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Audra elects § 179 for Asset B and Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra elects not to take additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Definitions:

Forms

In logic, refers to the various shapes or structures that arguments or propositions can take, based on the arrangement of their terms or components.

Contradictory

In logical terms, referring to propositions that cannot both be true at the same time.

Proposition

A suggested plan or course of action.

O Proposition

In traditional logic, an O proposition is a type of categorical statement that asserts some S are not P, where S and P are the subject and predicate respectively.

Q4: Jake is always careful to arrive on

Q11: The maximum annual contribution to a Roth

Q15: According to the text,when it comes to

Q26: The key date for calculating cost recovery

Q68: On August 20,2010,May signed a 10-year lease

Q105: A taxpayer just changed jobs and incurred

Q109: What are the tax problems associated with

Q118: Which,if any,of the following expenses is subject

Q134: Carolyn is single and has a college

Q148: Bob and April own a house at