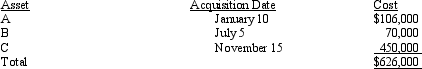

Audra acquires the following new five-year class property in 2011:

Audra elects § 179 for Asset B and Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra elects not to take additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Audra elects § 179 for Asset B and Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra elects not to take additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Definitions:

Perpendicular Directions

directions at right angles (90 degrees) to each other.

Nonperpendicular Directions

Directions or orientations that are not at a right angle (90 degrees) to a baseline or reference point.

Explosive Volcanic Eruption

A volcanic eruption characterized by the violent expulsion of magma, gas, and debris from a volcano, often associated with high levels of volcanic ash and pyroclastic flows.

High Pressures

Refers to the condition of experiencing greater than normal atmospheric force, often found in deep-sea environments or during meteorological events.

Q8: According to Hocker and Wilmot,true negotiating involves

Q17: According to the text,all of the following

Q17: When people feel low power,they often engage

Q18: Bonnie purchased a new business asset (five-year

Q26: One risk of informal intervention is "becoming

Q39: Sharon made a $60,000 interest-free loan to

Q48: Which of the following is correct?<br>A) A

Q49: The portion of property tax on a

Q96: If the cost of uniforms is deductible,their

Q108: Barry purchased a used business asset (seven-year