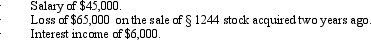

John files a return as a single taxpayer.In 2011,he had the following items:  Determine John's AGI for 2011.

Determine John's AGI for 2011.

Definitions:

Peristalsis

The rhythmic contraction of muscles that propels contents through the digestive system, ensuring the process of digestion progresses efficiently.

Blood Vessels

are tubular structures carrying blood throughout the body, including arteries, veins, and capillaries.

Peristalsis

A series of wave-like muscle contractions that move food through the digestive tract from the esophagus to the colon.

Smooth Muscle

An involuntary, non-striated muscle found within the walls of organs and structures such as the intestines, ureters, and blood vessels, responsible for regulating internal movements.

Q21: A taxpayer who claims the standard deduction

Q24: The Royal Motor Company manufactures automobiles.Employees of

Q24: Using the elements from either question #4

Q28: John had adjusted gross income of $60,000.During

Q37: Section 119 excludes the value of meals

Q52: Which of the following is not a

Q73: The cost recovery basis for property converted

Q77: Ted paid $73,600 to receive $10,000 at

Q117: Some transactions can qualify as either business

Q151: Qualified moving expenses of an employee that