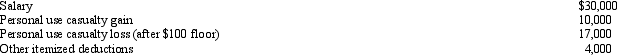

In 2011,Mary had the following items:  Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

Definitions:

Inflation

The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

Sum-Of-The-Years'-Digits Method

A depreciation method that accelerates the expense recognition, basing the depreciation for each year on a decreasing fraction of the depreciable amount.

Benefits Decline

A situation where the advantages or value derived from an asset or service decrease over time.

Depreciable Base

The cost of an asset less its salvage value, representing the total amount that can be depreciated over its useful life.

Q4: Describe and provide an example of the

Q16: Why is it potentially problematic to encourage

Q19: Ed died while employed by Violet Company.His

Q45: After the divorce,Jeff was required to pay

Q53: At the beginning of 2011,Mary purchased a

Q57: In 2011,Todd purchased an annuity for $200,000.The

Q64: For a vacation home to be classified

Q67: Corey performs services for Sophie.Which,if any,of the

Q69: Flora Company owed $95,000 to the National

Q93: A nonbusiness bad debt deduction can be