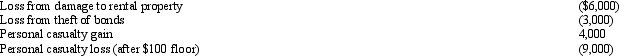

In 2011,Morley,a single taxpayer,had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

Definitions:

Personal Communication

Direct interaction between individuals, allowing for the exchange of information or ideas.

Prospective Customer

An individual or organization that could potentially purchase a product or service but has not yet done so.

Needs

Basic or necessary desires or requirements essential for an individual's well-being or the effective functioning of a system.

Conceptual Skills

The ability to see the selling process as a whole and the relationship among its parts.

Q1: According to the Difficult Conversations Guide,which of

Q7: Lori traditionally hosts Thanksgiving at her house

Q15: According to Hocker and Wilmot,which type of

Q18: In terms of gender,"both/and" power is often

Q20: A spiral that moves only one direction-upward

Q25: In what contexts might you damage your

Q36: If startup expenses total $50,000 in 2011,the

Q48: On February 15,2011,Martin signed a 20-year lease

Q79: Alvin is the sole shareholder of an

Q90: Diane purchased a factory building on November