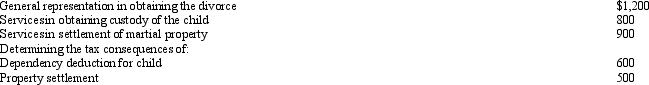

Velma and Josh divorced.Velma's attorney fee of $4,000 is allocated as follows:  Of the $4,000 Velma pays to her attorney,the amount she may deduct as an itemized deduction is:

Of the $4,000 Velma pays to her attorney,the amount she may deduct as an itemized deduction is:

Definitions:

Subjective Evaluation

The assessment or appraisal of work, performance, or artistry based on personal feelings, tastes, or opinions rather than objective criteria.

Performance Tests

Evaluations designed to measure an individual's capabilities and achievements in specific areas.

Performance Appraisal Form

A document used by organizations to evaluate an employee's job performance over a specific period, often incorporating feedback and goal assessments.

Legal Document

A document that is formally executed and that can be legally enforceable, such as contracts, wills, or deeds.

Q30: Benny loaned $100,000 to his controlled corporation.When

Q32: Under the automatic mileage method,one rate does

Q33: Mallard Corporation furnishes meals at cost to

Q34: A participant has an adjusted basis of

Q53: Five years ago,Tom loaned his son John

Q55: The concept of depreciation assumes that the

Q70: Briefly explain the provisions regarding the deductibility

Q71: Harold bought land from Jewel for $150,000.Harold

Q99: Since an abandoned spouse is treated as

Q118: Discuss the application of the "one-year rule"