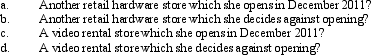

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2011 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2011 if the business is:

Definitions:

Command-based Economy

An economic system where production, investment, prices, and incomes are determined centrally by a government.

Discretionary Income

The amount of an individual's income that is left for saving, investing, or spending after taxes and basic necessities have been paid.

Gross National Income Per Capita

A measure that calculates the average income earned per person in a country, taking into account all residents' incomes.

Net National Income Per Capita

An economic metric that measures the total net income of a nation divided by its population, indicating the average income of its citizens.

Q41: Albert had a terminal illness which required

Q57: A complex trust pays tax on the

Q59: Nicole moved from California to Dallas to

Q60: If a scholarship does not satisfy the

Q86: The Green Company,an accrual basis taxpayer,provides business-consulting

Q87: In applying the gross income test in

Q90: A nonbusiness bad debt is a debt

Q96: In some foreign countries,the tax law specifically

Q97: The $25 limitation on the deductibility of

Q104: Taylor performs services for Jonathan on a