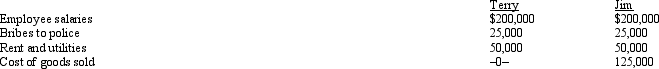

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Concealment

The act of hiding or withholding information or facts intentionally.

Nondisclosure

Refers to the act of not sharing certain information that is usually confidential or proprietary.

Assertion

A confident and forceful statement of fact or belief.

Unintentional

An action or outcome occurring without deliberate intent or plan.

Q10: The Bard Estate incurs a $25,000 fee

Q23: Rhonda has a 30% interest in the

Q24: Woody owns a barber shop.The following selected

Q28: Jerry purchased a U.S.Series EE savings bond

Q29: The tax law specifically provides that a

Q31: Linda delivers pizzas for a pizza shop.On

Q49: Orange Corporation begins business on April 2,2011.The

Q59: Last year,Green Corporation incurred the following expenditures

Q89: In a direct transfer from one qualified

Q143: Which of the following cannot be deducted