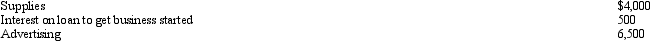

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Definitions:

Compounded Quarterly

The process where interest on an investment is calculated and added to the principal every three months, contributing to the growth of the investment amount.

Compounded Monthly

Entails the regular addition of interest to the principal balance of a loan or deposit every month, affecting overall returns or costs.

Semi-monthly Payments

Payments that are made twice a month, often on the 1st and 15th, typically in the context of salaries or loans.

Loan to Value Ratio

A financial term used by lenders to express the ratio of a loan to the value of an asset purchased.

Q4: Trade or business expenses are classified as

Q10: Which,if any,of the following is subject to

Q29: The exclusion of interest on educational savings

Q42: Theresa,a cash basis taxpayer,purchased a bond on

Q47: On April 5,2011,Orange Corporation purchased,and placed in

Q47: Red Company is a proprietorship owned by

Q57: A complex trust pays tax on the

Q58: April is a 40% partner in Pale

Q77: At age 65,Camilla retires from her job

Q126: Pedro is married to Consuela,who lives with