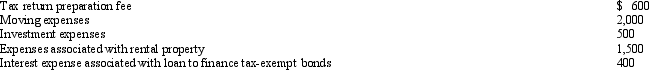

Cory incurred and paid the following expenses:  Calculate the amount that Cory can deduct (before any percentage limitations) .

Calculate the amount that Cory can deduct (before any percentage limitations) .

Definitions:

Cash Basis

An accounting method where revenues are recognized when cash is received and expenses are recognized when paid.

Costs Expire

This concept relates to the recognition of expenses in the income statement when the underlying value or utility of the cost is consumed or no longer exists.

Operating Cycle

The time period between purchasing raw materials and collecting cash from selling finished goods, measuring the efficiency of a company's operations and cash flow.

Extraordinary Item

Unusual and infrequent gains or losses on a company's financial statements, not expected to recur in the foreseeable future, a concept that has been phased out in many accounting standards.

Q3: Ellen,age 39 and single,furnishes more than 50%

Q28: On May 2,2011,Karen placed in service a

Q43: In the case of a below-market loan

Q56: In satisfying the support test and the

Q63: Lloyd,a practicing CPA,pays tuition to attend law

Q69: Flora Company owed $95,000 to the National

Q69: Why are there restrictions on the recognition

Q103: Mark is a cash basis taxpayer.He is

Q117: Jim is single and for 2011 has

Q125: The realization requirement applies to taxable income