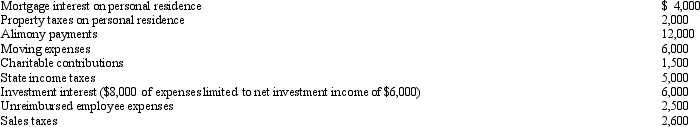

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Definitions:

Athletic Shoes

Footwear designed for sports or other forms of physical exercise, offering specific performance benefits such as cushioning, stability, or traction.

Subtle Messages

Indirect or not immediately obvious messages that can influence thoughts, behaviors, or perceptions.

Internet Dating

A method of starting and developing romantic relationships through websites and apps dedicated to matchmaking and personal connections.

Suzanne Schlosberg

This term does not correspond to a widely recognized concept or individual in psychological literature by this date; it might refer to a specific person not broadly known in the field.

Q29: Bertha had the following transactions during 2011:<br>

Q50: Orange Cable TV Company,an accrual basis taxpayer,allows

Q63: Perry is in the 33% tax bracket.During

Q72: Which of the following are deductions for

Q82: On January 15,2011,Vern purchased the rights to

Q88: On June 1,2011,James places in service a

Q88: How can an individual's consultation with a

Q113: Residential rental real estate includes property where

Q128: Darcy had the following transactions for 2011:<br>

Q143: Which of the following cannot be deducted