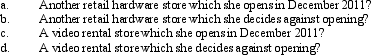

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2011 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2011 if the business is:

Definitions:

Probable Cause

A reasonable ground for belief in the existence of facts warranting certain actions, such as the issuance of a warrant.

Nolo Contendere

A legal plea whereby a defendant in a criminal case does not admit guilt but also does not dispute the charges, allowing for a conviction without an admission of guilt.

Grand Jury

A legal body empowered to conduct official proceedings to investigate potential criminal conduct and to determine whether criminal charges should be brought.

U.S. Constitution

The foundational document of the United States laying out the structure of the federal government, the division of powers, and the rights of citizens.

Q16: Sylvia,age 17,is claimed by her parents as

Q24: For all property placed in service in

Q34: Under the income tax formula,a taxpayer must

Q48: Which of the following is correct?<br>A) A

Q50: Sarah furnishes more than 50% of the

Q63: Travis and Andrea were divorced.Their only marital

Q63: Alicia was involved in an automobile accident

Q112: For real property,the ADS convention is the

Q131: A cash basis taxpayer who charges an

Q139: Beneficiary Terry received $30,000 from the Urgent