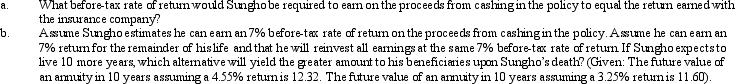

Sungho is married,files a joint return,and expects to be in the 35% marginal tax bracket for the foreseeable future.All of his income is from salary and all of it is used to maintain the household.He has a paid-up life insurance policy with a cash surrender value of $50,000.He paid $20,000 of premiums on the policy.His gain from cashing in the life insurance policy would be ordinary income.If he retains the policy,the insurance company will pay him $2,500 (5%)interest each year.Sungho thinks he can earn a higher return if he cashes in the policy and invests the proceeds.

Definitions:

Cash Dividend

A cash dividend is a payment made by a company out of its earnings to shareholders, usually in the form of cash.

Stock Dividend

A dividend payment made to shareholders in the form of additional company shares rather than cash.

Retained Earnings

Profits that a company has earned to date, less any dividends or other distributions paid to shareholders, often reinvested in the business.

Restricted

Restricted typically refers to assets or securities that are not freely tradable or accessible due to regulations or specific conditions.

Q6: If a taxpayer cannot satisfy the three-out-of-five

Q10: In 2011,Theresa was in an automobile accident

Q37: Taxable income for purposes of § 179

Q40: Employers can provide numerous benefits to their

Q58: Discuss the criteria used to determine whether

Q92: Rex,a cash basis calendar year taxpayer,runs a

Q96: Katrina,age 16,is claimed as a dependent by

Q112: The Gibson Estate is responsible for the

Q119: Sandra owns an insurance agency.The following selected

Q139: Kyle and Liza are married and under