Essay

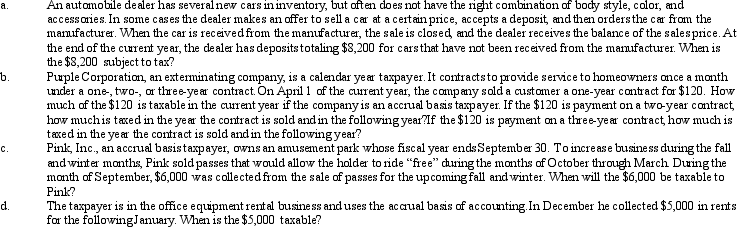

Determine the proper tax year for gross income inclusion in each of the following cases.

Definitions:

Related Questions

Q2: Manfredo makes a donation of $50,000 to

Q27: Payments by a cash basis taxpayer of

Q44: An IRS letter ruling might determine that

Q64: In 2011,Marci is considering starting a new

Q75: If a vacation home is a personal/rental

Q77: For an expense to be deducted as

Q113: The taxpayer is a Ph.D.student in accounting

Q116: If an activity involves horses,a profit in

Q117: Gain or loss is recognized by a

Q128: The Jain Trust is required to pay