Multiple Choice

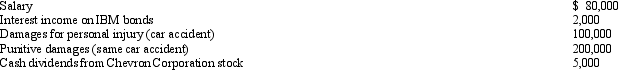

During 2011,Anna had the following transactions:  Anna's AGI is:

Anna's AGI is:

Definitions:

Related Questions

Q20: Edward operates an illegal drug-running business and

Q30: Ted earned $150,000 during the current year.He

Q32: Clara underpaid her taxes by $50,000.Of this

Q33: A CPA can take a tax return

Q55: Monique is a citizen of the U.S.and

Q65: As a result of an auto accident

Q112: Distinguish between deductible bribes and nondeductible bribes.

Q124: Paul,a U.S.citizen,will avoid the Federal estate tax

Q125: The Booker Trust is your client.Complete the

Q138: There are several business tax credits that