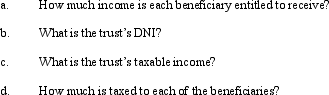

The LMN Trust is a simple trust that correctly uses the calendar year for tax purposes.Its income beneficiaries (Kathie,Lynn,Mark,and Norelle)are entitled to the trust's annual accounting income in shares of one-fourth each.For the current calendar year,the trust has ordinary business income of $30,000,a long-term capital gain of $20,000 (allocable to income),and a trustee commission expense of $4,000 (allocable to corpus).Use the format of Figure 28.3 in the text to address the following items.

Definitions:

Product Value

The perceived worth of a product or service to the customer, often influenced by its utility, quality, and the benefits it provides.

Pipeline Costs

Refers to the expenses associated with the operation, maintenance, and construction of pipelines used to transport goods, liquids, or gases.

Predominantly Fixed

A term describing costs or attributes that remain constant and do not vary significantly with activity level.

Intermodal Growth

The expansion and increased use of combining different modes of transportation (such as rail, ship, and truck) for the efficient movement of goods.

Q1: Regarding the Tax Tables applicable to the

Q11: A _ trust is a revocable entity

Q42: The privilege of confidentiality applies to a

Q59: Which of the following statements correctly reflects

Q66: Jack received a court award in a

Q90: The Williamson Estate generated distributable net income

Q103: In 2011,Justin had the following transactions: <img

Q112: The Gibson Estate is responsible for the

Q113: A nonresident alien is defined as someone

Q120: In the year in which an estate