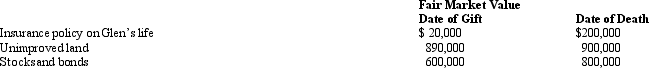

In 2009,Glen transferred several assets by gift to different persons.Glen dies in 2011.Information regarding the properties given is summarized below.  The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Glen's gross estate must include:

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Glen's gross estate must include:

Definitions:

Variable Interval

Variable interval refers to a type of reinforcement schedule in operant conditioning where a response is rewarded after an unpredictable amount of time has passed, leading to a steady and resistant response rate.

Variable Ratio

A schedule of reinforcement where a response is reinforced after an unpredictable number of responses, making it highly resistant to extinction.

Fixed Interval

A reinforcement schedule where a reward is given after a predetermined time period has passed following a response.

Fixed Ratio

A schedule of reinforcement where a response is reinforced only after a specified number of correct responses, often leading to high rates of response.

Q14: In conducting multistate tax planning,the taxpayer should:<br>A)

Q25: Debby,age 18,is claimed as a dependent by

Q43: Matt and Patricia are husband and wife

Q44: The Whitmer Trust operates a manufacturing business

Q57: It is advisable that an IRS audit

Q75: Which of the following is a typical

Q113: The current $5 million exemption equivalent applies

Q115: In some states,an S corporation must withhold

Q136: During 2011,Marvin had the following transactions: <img

Q144: Doyle died in 2000 and by will