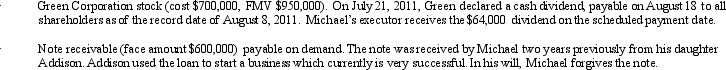

At the time of his death on August 7,2011,Michael owned the following assets.

How much,as to these transactions,is included in Michael's gross estate?

How much,as to these transactions,is included in Michael's gross estate?

Definitions:

Branded Social Interactions

Online engagements between consumers and brands on social media platforms that are influenced by the brand's messaging or presence.

Social Interactions

Exchanges between individuals or groups, often facilitated by digital platforms, that involve communication, collaboration, or other forms of social engagement.

Social Snackers

Individuals who consume small amounts of content from various social media platforms throughout the day, without engaging deeply with any particular piece.

Highly Interconnected

Elements, systems, or people that are closely linked and capable of exchanging information or resources efficiently and quickly.

Q35: U.S.income tax treaties:<br>A) Provide rules by which

Q38: List the three major functions of distributable

Q39: Sharon made a $60,000 interest-free loan to

Q51: The Code defines a "simple trust" as

Q54: In terms of income tax consequences,abandoned spouses

Q62: Warren,age 17,is claimed as a dependent by

Q110: Sandy pays a local college for her

Q121: Betty purchased an annuity for $24,000 in

Q149: Which of the following is not a

Q165: Waldo is his mother's sole heir and