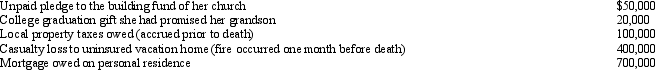

At the time of her death in 2011,Amber owns property worth $4,000,000.Other information regarding her affairs is as follows.

All of these items (except the casualty loss)were paid by her estate and none were deducted on Form 1041 (income tax return of the estate).What is Amber's taxable estate?

All of these items (except the casualty loss)were paid by her estate and none were deducted on Form 1041 (income tax return of the estate).What is Amber's taxable estate?

Definitions:

Environments

The surroundings or conditions in which a person, plant, or animal lives or operates, including both natural and man-made contexts.

Divergent Thinking

An aspect of creativity that involves thinking in varied and unique directions in order to generate multiple solutions for a given problem.

Possible Solutions

Various options or strategies that could be implemented to solve a problem or address a situation.

Expanding

Growing or increasing in size, volume, or scope; extending or spreading out from a center or in all directions.

Q2: Manfredo makes a donation of $50,000 to

Q4: Entity accounting income is controlled by the

Q12: The Raja Trust operates a welding business.Its

Q31: In meeting the criteria of a qualifying

Q41: Which of the following statements regarding the

Q60: Jake,an individual calendar year taxpayer,incurred the following

Q65: An LLC apportions and allocates its annual

Q81: Benjamin,age 16,is claimed as a dependent by

Q112: George,a calendar year taxpayer subject to a

Q122: To file for a tax refund,an individual