Compute the failure to pay and failure to file penalties for John,who filed his 2010 income tax return on December 14,2011,paying the $10,000 amount due.On April 1,2011,John submitted a six-month extension of time in which to file his return; he paid no tax with the extension request.He has no reasonable cause for failing to file his return by October 15 or for failing to pay the tax that was due on April 15,2011.John's failure to comply with the tax laws was not fraudulent.

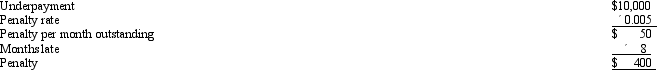

Failure to Pay

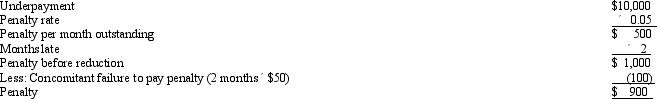

Failure to File

Failure to File

Definitions:

Parental Investment

Any contribution by a parent to an offspring that increases the offspring's chance of surviving and reproducing at the cost of the parent's ability to invest in other offspring.

R-Selection

Pattern of natural selection in which producing the most offspring the most quickly is adaptive; occurs when population density is low and resources are abundant.

Ecological Footprint

Area of Earth’s surface required to sustainably support a particular level of development and consumption.

World Average

A statistical average or median metric that represents global data across various categories, such as temperature, income, or health indicators.

Q11: Homer and Laura are husband and wife.At

Q16: The Crown Trust distributed one-half of its

Q29: A service engineer spends 60% of her

Q32: Performance,Inc.,a U.S.corporation,owns 100% of Krumb,Ltd.,a foreign corporation.Krumb

Q40: The distributable net income (DNI)of a fiduciary

Q88: Millie,age 80,is supported during the current year

Q93: In his will,Hernando provides for $50,000 to

Q98: In which of the following independent situations

Q111: The death of a tenant in common

Q148: Mitch pays the surgeon and the hospital