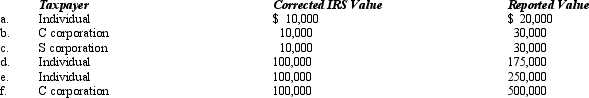

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal income tax rate of 35%.

Definitions:

Independent Contractor

A person who provides services to another entity under terms specified in a contract, but is not considered an employee of the company.

Office Equipment

Tangible property like desks, chairs, computers, and printers used in an office setting to facilitate work and operations.

Later Transfer

The act of moving or conveying property, rights, or entitlements to another party at a future date.

Contract

A legally binding agreement between two or more parties that outlines obligations each party must perform.

Q8: Harry,the sole income beneficiary,received a $40,000 distribution

Q18: Wood,a U.S.corporation,owns Holz,a German corporation.Wood receives a

Q31: In meeting the criteria of a qualifying

Q35: Regarding head of household filing status,comment on

Q37: The IRS processes about _ million individual

Q54: Estates and trusts can claim Federal income

Q72: Simpkin Corporation owns manufacturing facilities in States

Q74: RedCo,a domestic corporation,incorporates its foreign branch in

Q122: The excise tax imposed on private foundations

Q143: Calvin's will passes $800,000 of cash to