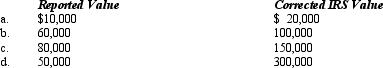

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal estate tax rate of 45%.

Definitions:

Embryonic Stage

The period in prenatal development from the second to the eighth week after fertilization, during which major organs and structures of the organism begin to develop.

Fetal Stage

The developmental period in pregnancy from the ninth week after fertilization until birth, when significant growth and maturation of the fetus occur.

Phenotype

The set of observable characteristics of an individual resulting from the interaction of its genotype with the environment.

Genotype

The underlying combination of genetic material present (but not outwardly visible) in an organism.

Q6: Orange,Inc.,a private foundation,engages in a transaction with

Q14: The Ulrich Trust has distributable net income

Q37: The IRS processes about _ million individual

Q45: The Rodriguez Trust generated $100,000 in alternative

Q53: Tax planning usually dictates that high-income and

Q67: Barry pays State University for his daughter's

Q95: A Form 1041 must be filed by

Q99: For Federal estate tax purposes,the gross estate

Q104: The Jain Trust is required to pay

Q132: The alternative minimum tax does not apply