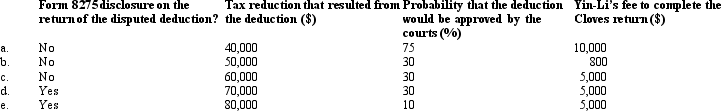

Yin-Li is the preparer of the Form 1120 for Cloves Corporation.On the return,Cloves claimed a deduction that the IRS later disallowed on audit.Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Q4: Lena is 66 years of age,single,and blind

Q6: Orange,Inc.,a private foundation,engages in a transaction with

Q39: Kyle,whose wife died in December 2008,filed a

Q60: Discuss how a multistate business divides up

Q75: Which of the following are organizations exempt

Q86: Personal property rental income is subject to

Q121: The Roz Trust has distributable net income

Q129: Given the following information,determine if FanCo,a foreign

Q132: A fiduciary arrangement creates a separate tax

Q145: Certain individuals are more likely than others