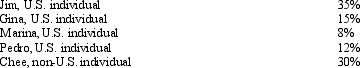

The following persons own Schlecht Corporation,a foreign corporation.  None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?

None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?

Definitions:

Euthanasia

The practice of intentionally ending a life to relieve pain and suffering, often in the context of terminal illness.

Legal Status

The condition of being recognized by the law, which affects a person's or entity's rights, duties, and legal capacities.

Report Well-Being

The act of expressing or documenting one's state of health, happiness, and prosperity, typically within the context of psychological or social research.

Physical Health

The overall condition of an individual's body, including the absence of disease and the fitness level of various bodily functions.

Q5: During the current year,the Santo Trust received

Q8: The starting point in computing state taxable

Q41: Garcia Corporation is subject to tax in

Q47: Blue,Inc.,receives its support from the following sources.

Q67: The Leonardo Estate operates a business and

Q78: The income from a bingo game conducted

Q90: The typical state sales/use tax falls on

Q93: The Yan Estate is your client,as are

Q116: Is a trust subject to the alternative

Q146: Sam purchases a U.S.savings bond which he