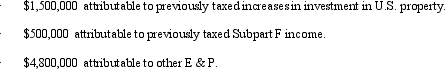

Steve,Inc.,a U.S.shareholder owns 100% of a CFC from which Steve receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.  Steve recognizes a taxable dividend of:

Steve recognizes a taxable dividend of:

Definitions:

Equity Funds

Mutual funds that primarily invest in company stocks, representing ownership in those companies.

Secured Loan

A loan that requires collateral as security for the lender.

Collateral

Assets that a borrower offers to a lender to secure a loan, which can be seized if the borrower fails to repay the loan.

SBA Loan

A loan made to a small business through a commercial bank, of which a portion is guaranteed by the Small Business Administration.

Q18: List some of the most commonly encountered

Q52: An "office audit" takes place at the

Q60: The § 367 cross-border transfer rules seem

Q63: USCo,a domestic corporation,receives $100,000 of foreign-source income

Q66: When loss assets are distributed by an

Q76: Which of the following statements is false

Q87: An S shareholder's basis is decreased by

Q121: Scott,Inc.,a domestic corporation,receives a dividend of $700,000

Q138: In the context of civil tax fraud,the

Q153: The LIFO recapture tax is a variation