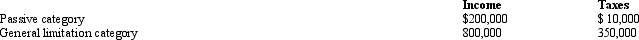

Britta,Inc.,a U.S.corporation,reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Definitions:

Introverted

A trait in someone's personality that prioritizes inner sensations rather than influences from the outside environment.

Behavioral Tendencies

Behavioral tendencies refer to predictable patterns of behavior and reaction that individuals typically exhibit.

Brain Structures

The physical parts and anatomical areas of the brain, each with specific functions.

Brain Arousal

The state of being physiologically alert and responsive to stimuli.

Q3: In most states,medical services are exempt from

Q11: Which of the following transactions by a

Q18: An S corporation's separately stated items are

Q49: At the time of his death in

Q51: During 2011,Oxen Corporation incurs the following transactions.

Q52: Although qualified tuition plans under § 529

Q54: Magdala is a citizen of Italy and

Q64: Which of the following is one of

Q73: A state wants to increase its income

Q100: The Code's scope of privileged communications for