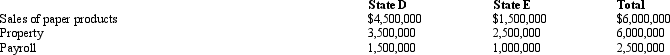

Milt Corporation owns and operates two facilities that manufacture paper products.One of the facilities is located in State D,and the other is located in State

E. E does not distinguish between business and nonbusiness property. D apportions business income. Milt's activities within the two states are outlined below.

E. Milt generated $1,200,000 of taxable income, comprised of $1,000,000 of income from its manufacturing facilities and a $200,000 gain from the sale of nonbusiness property located in

Definitions:

Dependency Theory

A theory proposing that economic conditions in poorer countries are the result of exploitative policies and practices by more developed countries.

Economic Underdevelopment

A condition in which a country or region is not achieving its economic potential, marked by low GDP per capita, poverty, and low levels of industrialization.

Multinational Corporations

Large companies that own or control production of goods or services in one or more countries other than their home country.

Siphoning Off

The act of diverting or redirecting resources, funds, or energy from one area to another, often in a manner that is secretive or not sanctioned.

Q5: In a proportionate liquidating distribution in which

Q6: The IRS can waive the penalty for

Q23: José Corporation realized $600,000 taxable income from

Q34: A widower and his spouse's estate are

Q56: Rose,Inc.,a qualifying § 501(c)(3)organization,incurs lobbying expenditures of

Q79: Allison and Taylor form a partnership by

Q84: An appropriate transfer price is one that

Q148: A partnership has accounts receivable with a

Q150: Which statement is incorrect with respect to

Q151: Define "trade or business" for purposes of