Mercy Corporation,headquartered in F,sells Wireless Computer Devices,including Keyboards and Bar

Mercy Corporation,headquartered in F,sells wireless computer devices,including keyboards and bar code readers.Mercy's degree of operations is sufficient to establish nexus only in E and F.Determine its sales factor in those states.

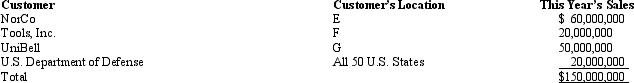

State E applies a throwback rule to sales,while State F does not.State G has not adopted an income tax to date.Mercy reported the following sales for the year.All of the goods were shipped from Mercy's F manufacturing facilities.

Definitions:

Variable Manufacturing Overhead

Costs that vary with the level of production output and can include expenses such as utilities and materials used in the production process.

Direct Labor-Hours

The total hours worked by employees directly involved in manufacturing a product or delivering a service.

Fixed Manufacturing Overhead

refers to the manufacturing costs that do not vary with the volume of production, such as rent and salaries.

Job-Order Costing System

An accounting method used to allocate costs to specific jobs or orders, typically used in situations where products or services are distinct and made to order.

Q9: Match each of the following statements with

Q21: For S corporation status to apply in

Q21: Cruz Corporation owns manufacturing facilities in States

Q24: At the time of her death in

Q55: Henry contributes property valued at $60,000 (basis

Q66: Which requirements must be satisfied for an

Q74: The MNO Partnership,a calendar year taxpayer,was formed

Q105: The IRS can use § 482 reallocations

Q127: Troy,an S corporation,is subject to tax only

Q149: Well,Inc.,a private foundation,makes a speculative investment of