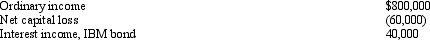

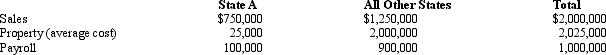

You are completing the State A income tax return for Quaint Company.Quaint is a limited liability company,and it operates in various states,showing the following results.

In A,all interest is treated as business income.A uses a sales-only apportionment factor.Compute Quaint's A taxable income.

In A,all interest is treated as business income.A uses a sales-only apportionment factor.Compute Quaint's A taxable income.

Definitions:

Annual Return

The percentage change in investment value over a one-year period, accounting for any dividends or interest received and capital gains or losses.

Retirement Nest Egg

A retirement nest egg is the amount of savings and investments that an individual has accumulated for their retirement years.

Compounding Of Interest

The process where interest is earned on both the initial principal and on the accumulated interest from previous periods.

Retirement

The period in an individual's life after they have ceased working, typically marked by eligibility for pensions or social security benefits.

Q11: According to the IRS,the annual "Tax Gap"

Q23: José Corporation realized $600,000 taxable income from

Q71: State Q has adopted sales-factor-only apportionment for

Q86: An S shareholder's stock basis includes a

Q91: Without the foreign tax credit,double taxation would

Q96: An S corporation recognizes a gain on

Q97: Which of the following statements regarding the

Q116: Which of the following statements is incorrect

Q135: Discuss the primary purposes of income tax

Q144: Assist,Inc.,a § 501(c)(3)organization,receives the following sources of