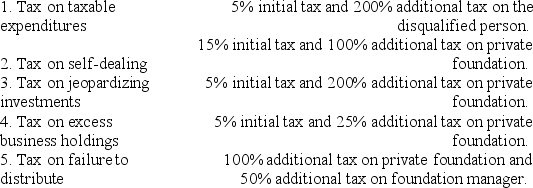

For each of the following taxes which are imposed on private foundations,match the appropriate initial tax or additional tax.

Definitions:

Exculpatory Clause

A contract provision that releases one party from liability for their wrongful acts to the other party.

Tort Liability

A legal responsibility arising from civil wrongs not based on contractual obligations, causing harm or loss to another person or entity, leading to potential compensation for damages.

Public Policy

Principles and standards considered by a government to be beneficial for the community and used as a guide for the development of laws.

Substantive Unconscionability

A legal principle in contract law that allows courts to refuse to enforce a contract or clause deemed grossly unfair or one-sided.

Q13: Engaging in a prohibited transaction can result

Q21: For S corporation status to apply in

Q66: AirCo,a domestic corporation,purchases inventory for resale from

Q75: A capital loss allocated to a shareholder

Q87: Warmth,Inc.,a private foundation,makes an expenditure of $800,000

Q91: For Federal income tax purposes,taxation of S

Q95: If a state follows Federal income tax

Q115: Meagan is a 40% general partner in

Q119: On Form 1065,partners' capital accounts should be

Q125: A church is required to obtain IRS