Essay

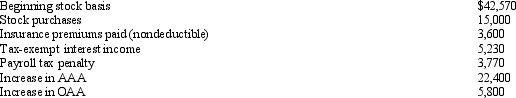

You are a 60% owner of an S corporation.Calculate your ending stock basis,based upon these facts.

Definitions:

Related Questions

Q7: Kim Corporation,a calendar year taxpayer,has manufacturing facilities

Q19: In corporate reorganizations,an acquiring corporation using property

Q24: Is there a materiality exception associated with

Q26: When a _ is in effect,out-of-state sales

Q37: How may an S corporation manage its

Q47: The gain recognized by a shareholder in

Q50: Any losses that are suspended under the

Q96: Define average acquisition indebtedness with respect to

Q109: An examination of the RB Partnership's tax

Q109: José Corporation realized $600,000 taxable income from