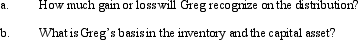

In a proportionate liquidating distribution in which the partnership is liquidated,Greg received cash of $20,000,inventory (basis of $2,000,fair market value of $3,000),and a capital asset (basis and fair market value of $4,000).Immediately before the distribution,Greg's basis in the partnership interest was $30,000.

Definitions:

Work Environment

The physical and psychological conditions under which employees perform their job duties, including the office layout, culture, and policies.

Social Identities

Aspects of a person's self-concept derived from perceived membership in social groups such as national, cultural, religious, and gender.

Gig Economy

A labor market characterized by the prevalence of short-term contracts or freelance work, as opposed to permanent jobs.

Lifetime Employees

A concept where employees stay with a single employer for the entirety of their career, often seen as offering stability and loyalty.

Q4: An estate can be an S corporation

Q15: Property distributed by a corporation as a

Q21: Schedule M-2 is used to reconcile unappropriated

Q85: Four individuals form Chickadee Corporation under §

Q86: Dividends paid to shareholders who hold both

Q102: If an S corporation shareholder's basis in

Q110: Which of the following statements is true

Q121: During the current year,MAC Partnership reported the

Q131: An organization that is a for-profit entity

Q134: An S corporation must possess the following