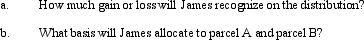

The JIH Partnership distributed the following assets to partner James in a proportionate liquidating distribution in which the partnership is liquidated: $25,000 cash,land parcel A (basis of $5,000,fair market value of $30,000),and land parcel B (basis of $5,000,fair market value of $15,000).James's basis in his partnership interest was $85,000 immediately before the distribution.

Definitions:

Brand Position

is the unique place a brand occupies in the minds of customers, distinguishing it from competitors.

Memorable

Something that is easily remembered or has a lasting impact on one's memory due to its uniqueness or emotional resonance.

Q10: Even though a church is not required

Q16: Which tax-related website probably gives the best

Q22: In the current year,Dove Corporation (E &

Q31: What are intermediate sanctions and to what

Q41: A corporation can revoke its S status

Q53: Stock basis first is increased by income

Q61: Hannah,Greta,and Winston own the stock in Redpoll

Q78: Owl Corporation,a C corporation,recognizes a gain on

Q104: Which of the following statements is correct?<br>A)

Q138: Several individuals acquire assets on behalf of