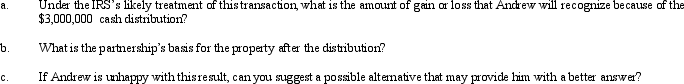

Andrew contributes property with a fair market value of $6,000,000 and an adjusted basis of $2,000,000 to AP Partnership.Andrew shares in $3,000,000 of partnership debt under the liability sharing rules,giving him an initial adjusted basis for his partnership interest of $5,000,000.One month after the contribution,Andrew receives a cash distribution from the partnership of $3,000,000.Andrew would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Andrew's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Language Skills

Abilities related to the comprehension, use, and production of spoken and written language, including grammar, vocabulary, and communication.

Verbal Environment

Refers to the surroundings in which a child is exposed to language through conversations, reading, and other forms of communication.

Bilingualism

The ability to understand and use two languages proficiently, which can enhance cognitive abilities and cultural awareness.

Bilingual Education

An educational program where students are taught in two languages.

Q3: Quail Corporation is a C corporation with

Q19: Individuals Adam and Bonnie form an S

Q34: A widower and his spouse's estate are

Q41: During the current year,John and Ashley form

Q48: Distributions that are not dividends are a

Q50: In the current year,Oriole Corporation donated a

Q74: Post-termination distributions that are charged against OAA

Q102: On January 1,Tulip Corporation (a calendar year

Q115: Meagan is a 40% general partner in

Q126: Which of the following statements are correct?<br>A)