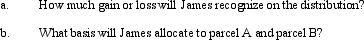

The JIH Partnership distributed the following assets to partner James in a proportionate liquidating distribution in which the partnership is liquidated: $25,000 cash,land parcel A (basis of $5,000,fair market value of $30,000),and land parcel B (basis of $5,000,fair market value of $15,000).James's basis in his partnership interest was $85,000 immediately before the distribution.

Definitions:

Privately Owned

A business that is owned by private individuals or entities and not by the government or public investors.

Shares Of Stock

Units of ownership in a corporation that give shareholders a claim on part of the corporation's earnings and assets.

Overhead

All ongoing business expenses not directly attributable to creating a product or service, including rent, utilities, and administrative costs.

Losing Money

The result of an investment or business activity where expenses and losses exceed revenues or gains.

Q13: Which is not a Code section number?<br>A)

Q15: A feeder organization is exempt from Federal

Q24: Which,if any,of the following is not an

Q26: Debt security holders recognize gain when the

Q39: Janet Wang is a 50% owner of

Q47: Blue,Inc.,receives its support from the following sources.

Q59: Which of the following is not an

Q82: An S corporation can be a partner

Q111: Betty's adjusted gross estate is $7 million.The

Q146: Pat is a 40% member of the