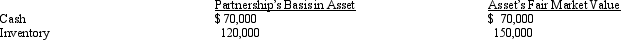

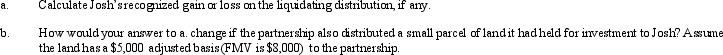

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $300,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Definitions:

Unemployment Compensation Benefits

Payments made to individuals who are temporarily out of work, providing financial support during unemployment.

Pink Slip

Informal term for the notice of dismissal given to an employee.

College Graduate

An individual who has received a degree from a college or university, indicating the completion of a specific program of study.

Cyclical Unemployment

Unemployment that results from business cycle fluctuations in the economy, typically increasing during recessions and decreasing during expansions.

Q30: Arizona is in the jurisdiction of the

Q34: Which of the following types of §

Q45: In the current year,Pink Corporation has a

Q56: Rose,Inc.,a qualifying § 501(c)(3)organization,incurs lobbying expenditures of

Q65: Daisy Corporation is the sole shareholder of

Q101: Which one of the following statements about

Q119: To maintain exempt status,an organization must do

Q120: In a redemption to pay death taxes,stock

Q145: S corporation status avoids the _ taxation

Q157: Which item does not appear on Schedule