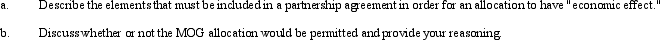

The MOG Partnership reports ordinary income of $60,000,long-term capital gain of $12,000,and tax-exempt income of $12,000.The partnership agreement provides that Molly will receive all long-term capital gains and George will receive all tax-exempt interest income.Their allocation of ordinary income will be reduced accordingly,and Olivia will be allocated a proportionately greater share of ordinary income.(In other words,each partner will receive allocations totaling 1/3 of the total $84,000 of partnership income.)This allocation was agreed upon because Molly and George are in a high marginal tax bracket and Olivia is in a low marginal tax bracket.

Definitions:

Q3: Quail Corporation is a C corporation with

Q5: On April 16,2010,Blue Corporation purchased 15% of

Q43: Which transaction affects the Other Adjustments Account

Q48: The stock of Brown Corporation (E &

Q67: Discuss the advantages and disadvantages of the

Q80: The terms "earnings and profits" and "retained

Q81: Compare the distribution of property rules for

Q88: Francisco is the sole owner of Rose

Q113: Tyler and Travis formed the equal T&T

Q142: Jared owns a 40% interest in the