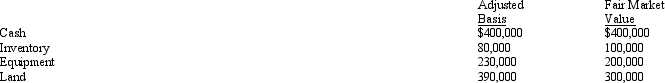

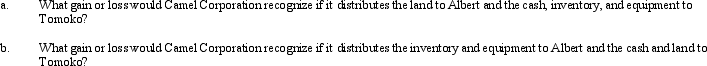

The stock in Camel Corporation is owned by Albert and Tomoko,who are unrelated.Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation.All of Camel Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Camel Corporation:

Definitions:

PowerPoint Presentation

A presentation tool developed by Microsoft, often used for educational, training, or business purposes to visually convey information.

Major Point

The most important or central idea, argument, or piece of information within a discussion or piece of writing.

Question And Answer

A conversational format where inquiries are posed and responses are provided, commonly used in interviews, discussions, and educational settings.

Plagiarism

The act of using someone else's work or ideas without giving proper credit, thereby presenting them as one's own.

Q1: Determination letters usually involve completed transactions.

Q20: For a taxpayer who is required to

Q27: Robert organized Redbird Corporation 10 years ago

Q32: Why are some organizations exempt from Federal

Q57: Woeful,Inc.,a tax-exempt organization,leases a building and machinery

Q58: Most Roth IRAs can own S corporation

Q60: Nick sells his 25% interest in the

Q87: Which of the following is not typically

Q120: Which of the following qualify as exempt

Q128: A realized gain from an involuntary conversion