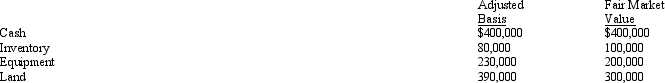

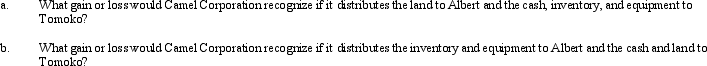

The stock in Camel Corporation is owned by Albert and Tomoko,who are unrelated.Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation.All of Camel Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Camel Corporation:

Definitions:

Except

To exclude or leave out from a group, list, or category.

Dreams

A series of thoughts, images, and sensations occurring in a person's mind during sleep, often reflecting subconscious concerns or desires.

Driving While Sleepy

Operating a vehicle when fatigued or drowsy, which can impair reaction times and decision-making, similar to driving under the influence of alcohol.

Driving While Drunk

Operating a vehicle under the influence of alcohol, which severely impairs judgment, coordination, and reaction times, creating a significant risk of accidents.

Q20: Erica transfers land worth $500,000,basis of $100,000,to

Q44: Pheasant Corporation ended its first year of

Q46: Brown Corporation purchased 85% of the stock

Q64: Which of the following is one of

Q74: The granting of a Writ of Certiorari

Q77: Which of the following requirements must be

Q98: Warbler Corporation,an accrual method regular corporation,was formed

Q129: Discuss the two methods of allocating S

Q150: Which statement is incorrect with respect to

Q151: Define "trade or business" for purposes of