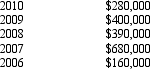

Duck Corporation is a calendar year taxpayer formed in 2005.Duck's E & P for each of the past 5 years is listed below.  Duck Corporation made the following distributions in the previous 5 years.

Duck Corporation made the following distributions in the previous 5 years.

2009 Land (basis of $700,000,fair market value of $800,000)

2006 $200,000 cash

Duck's accumulated E & P as of January 1,2011 is:

Definitions:

Isometric Drawing

A method of visual representation of a three-dimensional object, drawn on a two-dimensional surface where the three principal axes appear equally foreshortened.

Decimal Point

A dot or small symbol used to separate the integer part from the fractional part of a number in decimal notation.

Fractional-Inch

A unit of measurement in the customary system used in the United States, where measurements are expressed in fractions of an inch.

Reamers

Tools used to widen the size of a hole to precise dimensions and to improve its finish.

Q19: Rust Corporation has accumulated E & P

Q26: Lupe and Rodrigo,father and son,each own 50%

Q36: The LN partnership reported the following items

Q45: The text discusses four different limitations on

Q55: A taxpayer must pay any tax deficiency

Q58: The related-party loss limitation does not apply

Q74: In the case of a small home

Q112: Depreciation recapture income is a _ computed

Q121: It is beneficial for an S corporation

Q147: In a proportionate liquidating distribution in which