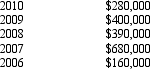

Duck Corporation is a calendar year taxpayer formed in 2005.Duck's E & P for each of the past 5 years is listed below.  Duck Corporation made the following distributions in the previous 5 years.

Duck Corporation made the following distributions in the previous 5 years.

2009 Land (basis of $700,000,fair market value of $800,000)

2006 $200,000 cash

Duck's accumulated E & P as of January 1,2011 is:

Definitions:

Exempt Employee

An employee who is exempt from overtime pay and minimum wage requirements, typically based on their job duties and salary level.

FLSA

The Fair Labor Standards Act, a US labor law that sets out minimum wage, overtime pay eligibility, recordkeeping, and child labor standards for full-time and part-time workers in the private sector and in federal, state, and local governments.

Exempt Workers

Employees not covered by the Fair Labor Standards Act (FLSA), often not eligible for overtime pay due to their job type.

Promissory Estoppel

A legal principle preventing a party from retracting a promise which the other party has reasonably relied upon to their detriment.

Q18: Match each of the following statements with

Q25: Magenta Corporation acquired land in a §

Q47: At the beginning of the year,Elsie's basis

Q48: Since most tax preferences are merely timing

Q69: Morgan and Kristen formed an equal partnership

Q80: An accrual basis taxpayer accepts a note

Q85: The installment method applies where a payment

Q93: Almond Corporation,a calendar year C corporation,had taxable

Q108: Ivory Corporation (E & P of $650,000)has

Q123: In applying the stock attribution rules to